Dan and Sally Harris leveraged a CGA to provide themselves with a fixed source of income while supporting future generations of Caltech students. Rick Robertson, executive director of the Office of Gift Planning, answers some common questions below that he receives regarding CGAs as a life income gift option.

Q. What are the benefits of a CGA?

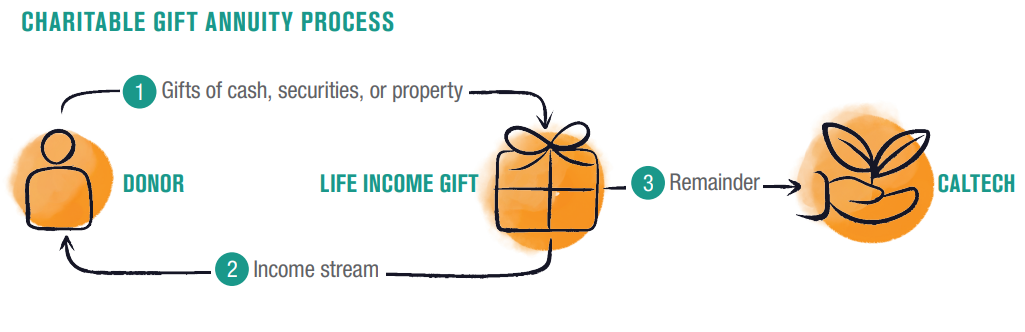

A. In exchange for a gift of a qualified charitable distribution (QCD), cash, or securities valued at $25,000 or more, Caltech will provide individuals reliable, fixed payments for life. When the gift annuity ends, its remaining principal passes to Caltech to support initiatives important to the donor.

Depending on the amount donated, a QCD lowers or completely offsets the donor’s required minimum distribution (RMD) for individual retirement accounts (IRAs), and donor and/or spouse receive fixed payments for life.

A gift of cash or securities gives the donor an immediate charitable deduction, and part of each payment is tax-free, increasing each payment’s after-tax value.

Q. Is this easy to set up?

A. Yes, a CGA is a simple contract between the donor and Caltech.

Q. Who can receive payments?

A. The donor chooses who will receive payments from the gift annuity. Often it can include a spouse or other close family member.

Q. How reliable is this payment?

A. Payments are backed by the general resources of the Institute and remain secure and dependable regardless of market conditions.

Q. Does the payout rate depend on age?

A. Yes, the older the income beneficiary, the larger the payment provided by Caltech. The minimum age is 60.

SAMPLE RATES AND PAYMENTS FOR A $100,000 GIFT

| Age | Annuity Rate | Annual Annuity |

|---|---|---|

| 90 | 10.1% | $10,100 |

| 85 | 9.1% | $9,100 |

| 80 | 8.1% | $8,100 |

| 75 | 7.0% | $7,000 |

| 70 | 6.3% | $6,300 |